Loading article content…

5 considerations when it comes to owning your own rooms

Categories:

- Sustainability

- Helping Hand Grants

- EOFY Essentials

- Partner Posts

- Home Buying and Borrowing

- Practice Purchase and Growth

- SMSF Borrowing and Benefits

- Practice Equipment and Fitout

- Health and Lifestyle

- Guides to Download

- Travel Series

- Practice + Life Case Studies

- News and Media

- Women in Medicine Series

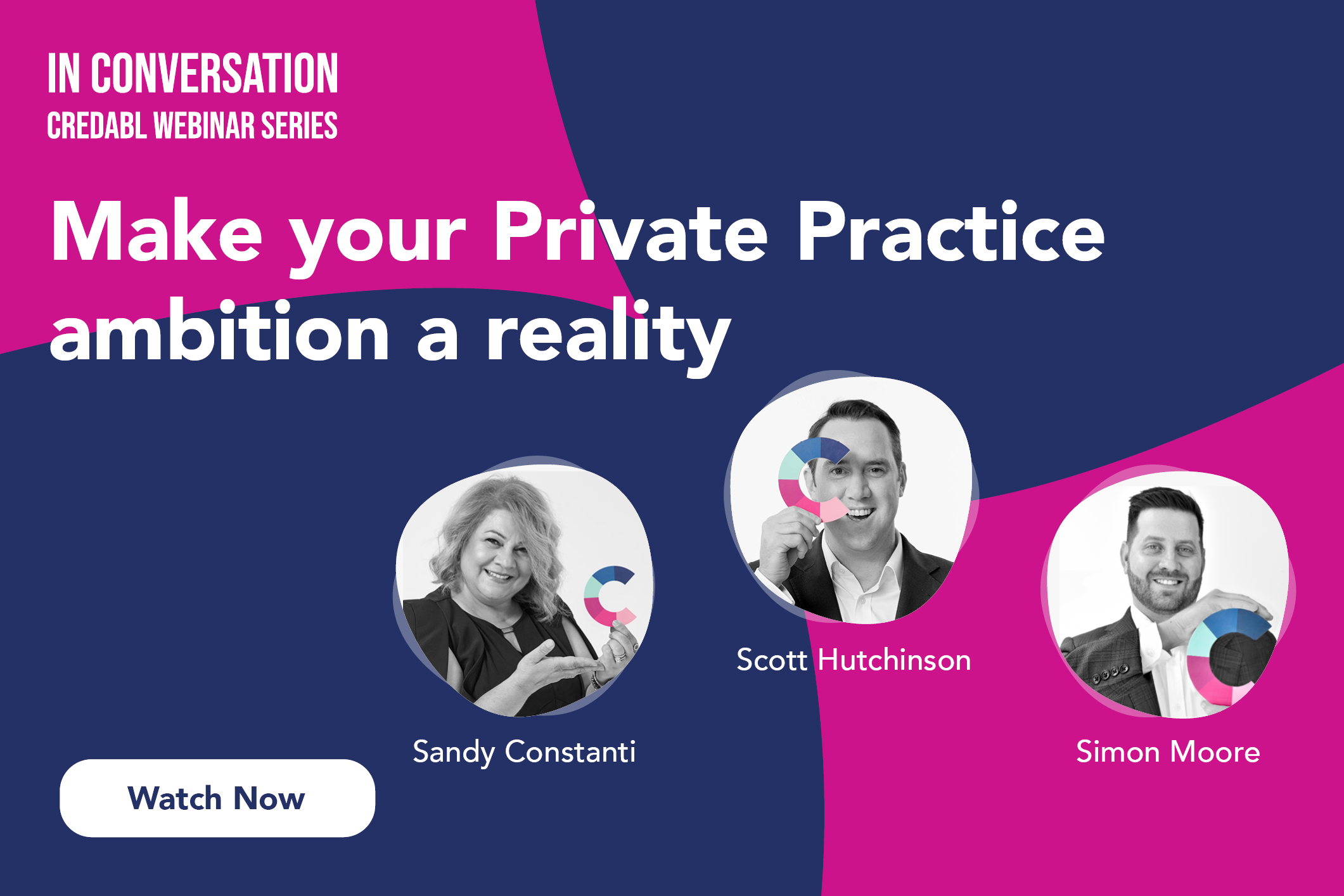

- In Conversation Webinars

- Finance Tips

- Beyond Graduation