Everyday cash flow, made simple.

Running a busy medical, dental or veterinary practice comes with constant expenses — from payroll and supplies to the unexpected. A Credabl Overdraft Facility gives you flexible access to working capital when you need it, helping you keep your cash flow healthy and your practice running smoothly.

Choose a secured or unsecured option designed specifically for healthcare professionals, with fast approvals, competitive rates and real support of finance experts who understand your world.

Access funds when you need them — so you can focus on your patients.

Our overdraft facility features.

Better medical finance can make a big difference to your practice.

$1 borrowed = 1 Qantas Point*

Ability to lower your interest bill, fees and charges

Access to money when you need it

Lower interest rates than a traditional overdraft

No need to use your home as security

*T&Cs apply. Find out more here.

"5 star service with quick and hassle free finance. Highly recommended."

"Exceptional staff and super easy process. I cannot recommend highly enough."

"The level of communication was much better than a lot of the bigger finance companies, big 4 included."

"5 star service with quick and hassle free finance. Highly recommended."

"Exceptional staff and super easy process. I cannot recommend highly enough."

More questions?

Here's a few frequently asked questions to get to know us better.

A Practice Build Loan is a type of medical construction loan designed specifically for healthcare professionals to fund the building of a new practice premises or an extension to the existing premises. It covers the full journey — commercial property purchase, construction and fitout.

The cost to build a medical or dental practice typically ranges from $3,000 to $8,000 per square metre depending on your desired fitout and compliance level:

- Entry-level: ~$3,000/sqm

- Mid-tier: ~$5,000/sqm

- Premium: ~$8,000/sqm

Latest articles.

Find out what's trending on the Credabl blog.

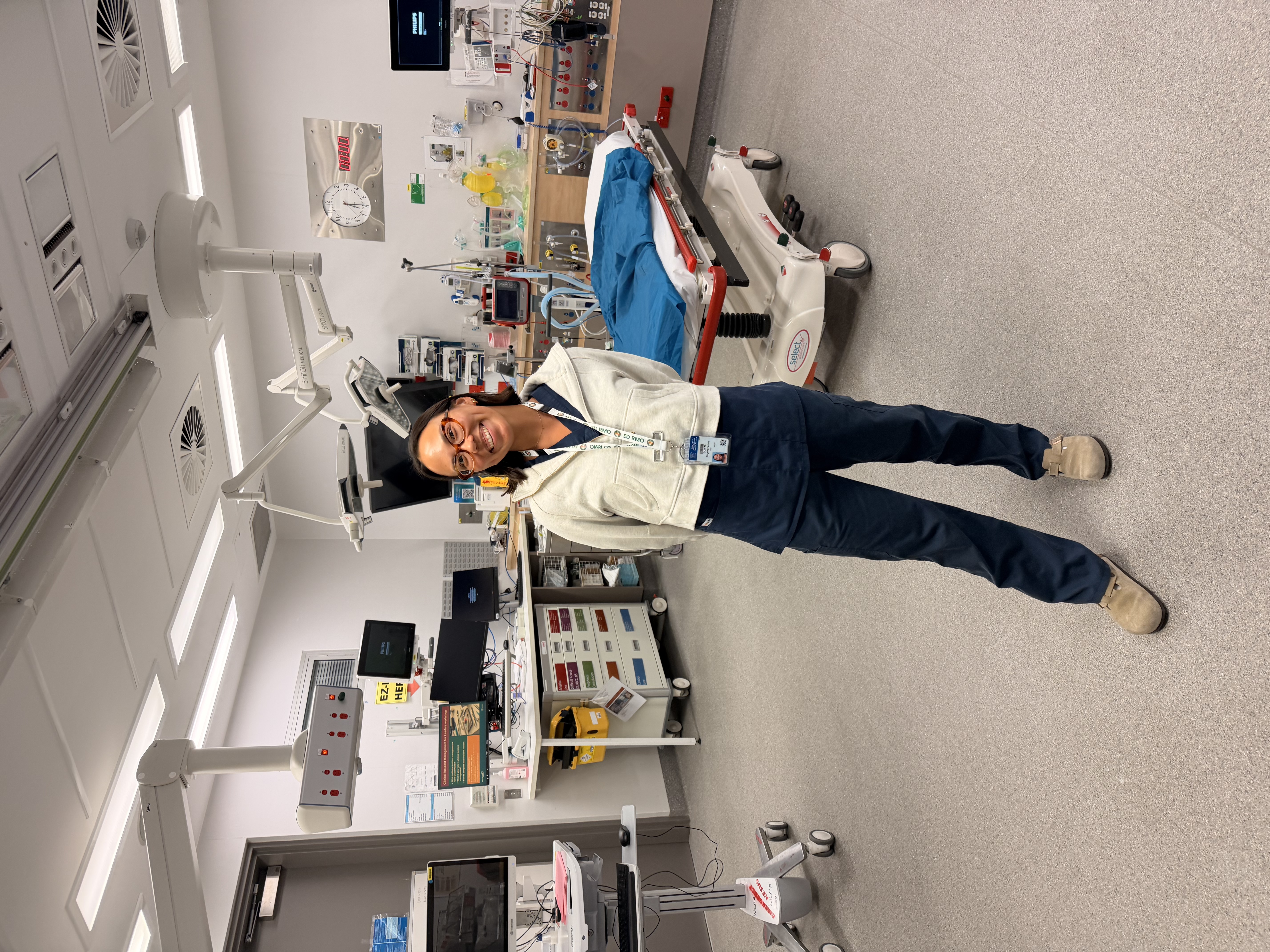

"You don’t look like a doctor": Dr Sonya on redefining medicine

Dr Sonya is part of a new generation quietly reshaping what medicine looks like. Her story highlights how women in healthcare are challenging outdated stereotypes and expanding...

How to turn 12 days of annual leave into 26 days of travel in 2026

Looking for the best way to maximise your annual leave in 2026? With smart planning around Australian public holidays, you can turn just 12 days of annual leave into 26 days of...

The exhaustion no one warned you about in medical, dental and vet work

Why feeling drained is often a predictable response to how clinical work is structured Exhaustion in clinical work is rarely just about long hours.