Bring your dream practice to life.

From cabinetry and lighting to patient comfort and finishing touches, Credabl’s Practice Fitout Loans make it easy to finance every detail of your space - not just the big-ticket items.

With tailored solutions designed to protect your cash flow and maximise flexibility, we help you bring your vision to life while keeping your business running smoothly. Whether you’re starting from scratch or giving your practice a new look, we’ll ensure your fitout finance supports your goals, your budget and your patients’ experience.

Create a space that reflects your care.

"5 star service with quick and hassle free finance. Highly recommended."

"Exceptional staff and super easy process. I cannot recommend highly enough."

"The level of communication was much better than a lot of the bigger finance companies, big 4 included."

"5 star service with quick and hassle free finance. Highly recommended."

"Exceptional staff and super easy process. I cannot recommend highly enough."

More questions?

Here's a few frequently asked questions to get to know us better.

Practice fitout loans are specific types of financing intended to help professionals in the healthcare sector finance the cost of setting up, renovating, or upgrading their practice. This includes purchasing or leasing necessary equipment, creating a welcoming environment, or even expanding to additional locations.

Latest articles.

Find out what's trending on the Credabl blog.

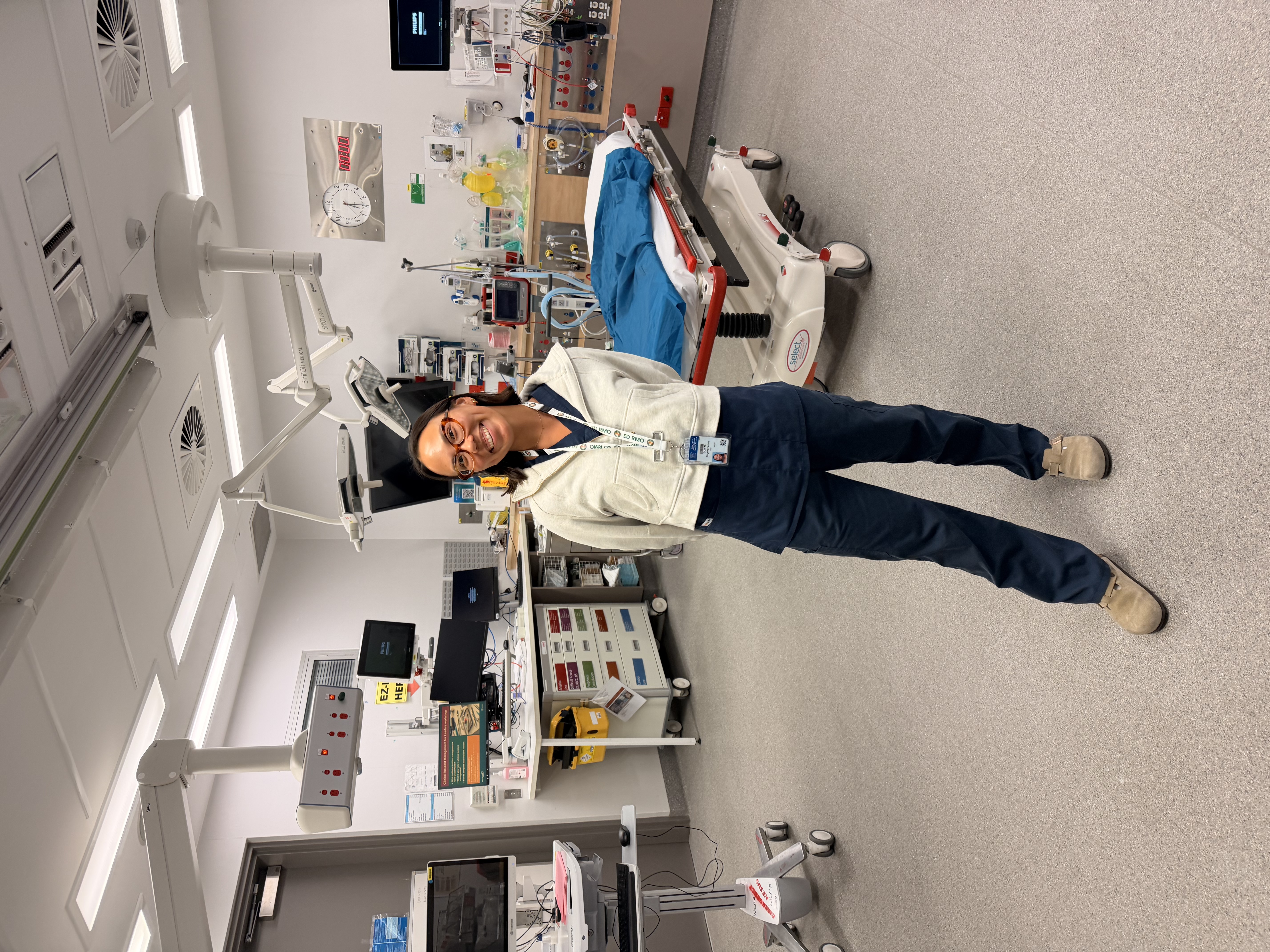

"You don’t look like a doctor": Dr Sonya on redefining medicine

Dr Sonya is part of a new generation quietly reshaping what medicine looks like. Her story highlights how women in healthcare are challenging outdated stereotypes and expanding...

How to turn 12 days of annual leave into 26 days of travel in 2026

Looking for the best way to maximise your annual leave in 2026? With smart planning around Australian public holidays, you can turn just 12 days of annual leave into 26 days of...

The exhaustion no one warned you about in medical, dental and vet work

Why feeling drained is often a predictable response to how clinical work is structured Exhaustion in clinical work is rarely just about long hours.