Home › Promotions › Property Report

Yes, I want a property report

Congratulations, you're one step closer to receiving a Credabl property report, powered by Cotality.

Get your property report.

Fill out the contact form below and in the comments field let us know your current or desired residential address so we can customise your Cotality property report.

Disclaimer

*Special offers only available on fixed commercial chattel mortgages. In relation to any promotions or offers by, relating to or referencing Credabl Pty Ltd (ACN 615 968 100) (“Credabl”) (“Credabl Promotions”), documents relating to the Credabl Promotion are a guide only and do not constitute any recommendation on behalf of Credabl. The information in any document relating to a Credabl Promotion is general in nature and Credabl has not taken into account your personal objectives or financial circumstances or needs when preparing it. Before acting on this information you should consider if it is suitable for your personal circumstances. Credabl is not offering financial, tax or legal advice. You should obtain independent financial, tax and legal advice as appropriate. Credabl reserves the right to cease offering these products at any time without notice. The Credabl Promotion is subject to Credabl’s terms and conditions, fees and charges and eligibility criteria, including credit approvals by Credabl. Not all applicants or equipment types will be eligible. The issuer and credit provider of the Credabl Promotion is Credabl Pty Ltd (ACN 615 968 100) Australian Credit Licence No. 499547.

More questions?

Here's a few frequently asked questions to get to know us better.

Unlike standard home loans, home loans for doctors are tailored to meet the unique financial needs of medical professionals. They take into account their career trajectory, earning potential and the likelihood of them becoming successful property owners. In many cases, lenders can offer higher borrowing limits, better interest rates and even waivers on Lender’s Mortgage Insurance (LMI) for doctors.

Yes, because of their stable, high-income careers, doctors could often be eligible for special home loan products. These can include competitive interest rates, higher borrowing limits and even LMI waivers. These special terms can make buying a home more accessible and affordable for doctors.

Latest articles.

Find out what's trending on the Credabl blog.

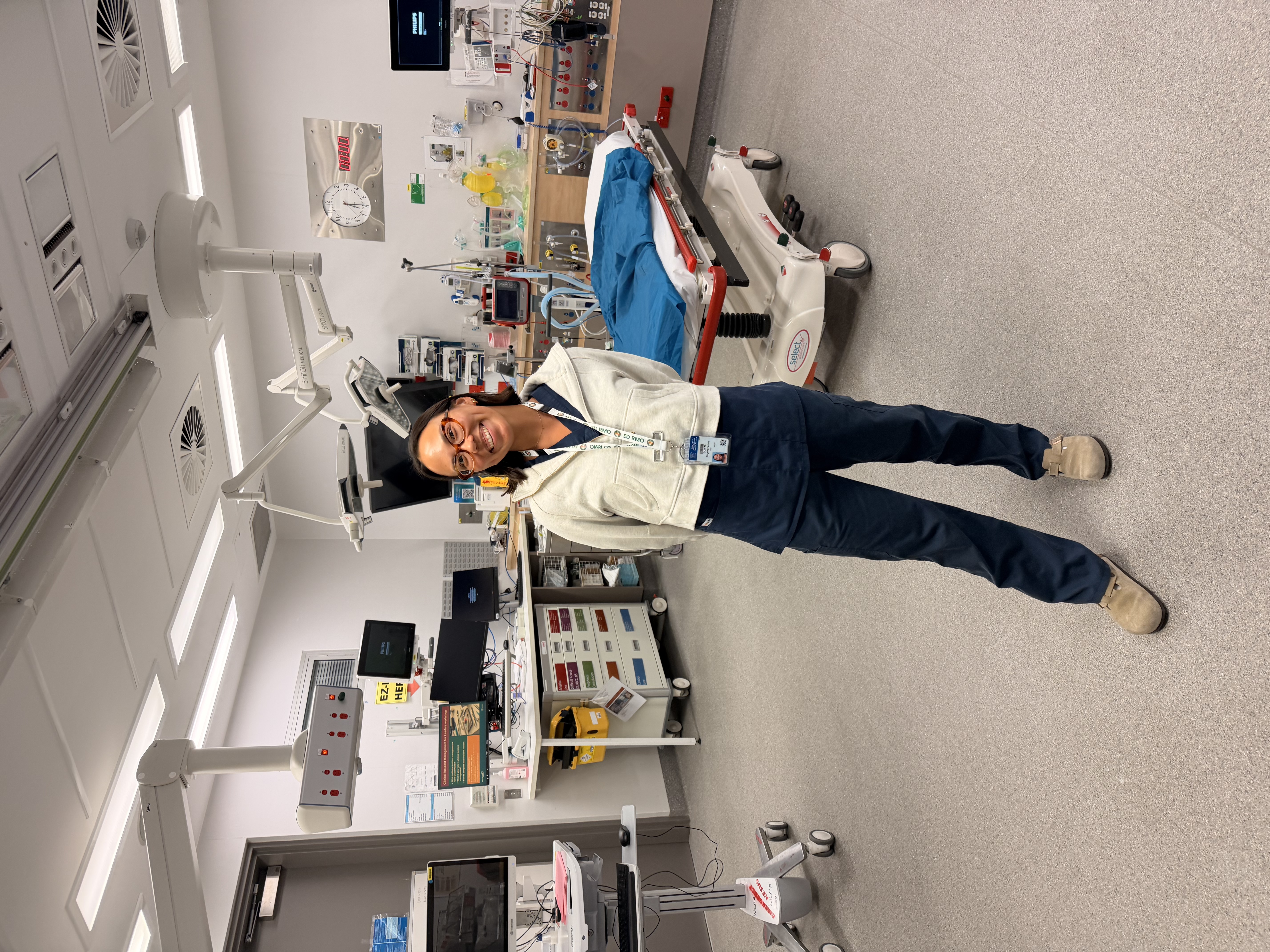

"You don’t look like a doctor": Dr Sonya on redefining medicine

Dr Sonya is part of a new generation quietly reshaping what medicine looks like. Her story highlights how women in healthcare are challenging outdated stereotypes and expanding...

How to turn 12 days of annual leave into 26 days of travel in 2026

Looking for the best way to maximise your annual leave in 2026? With smart planning around Australian public holidays, you can turn just 12 days of annual leave into 26 days of...

The exhaustion no one warned you about in medical, dental and vet work

Why feeling drained is often a predictable response to how clinical work is structured Exhaustion in clinical work is rarely just about long hours.